Points Rewards Credit Cards

Have you ever heard of a magic card that gives you cool stuff for spending money? Well, in the UAE, it's real, and it's called a Points Rewards Credit Card! These cards aren't just for buying stuff; they're like having a secret treasure chest of goodies waiting for you. In this post, we're diving into the incredible world of Rewards Credit Cards right here in the UAE. From getting free flights and fancy hotel stays to grabbing discounts at your favourite shops, these cards are like your money's sidekick, helping you get more bang for your buck. Whether you're a pro at using credit cards or you're just getting started, this series is your go-to guide. We'll break down how these magical cards work and share some tricks to make sure you're getting the most out of them. My Banker is here to make sure you're not just swiping your card but scoring big with all the amazing perks it has to offer right here in the awesome UAE!

What are Points Rewards Credit Cards?

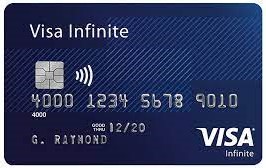

Points Rewards Credit Cards are a category of credit cards that incentivize users with points for every dollar spent on eligible purchases. These points can be redeemed for various rewards, including travel, merchandise, cash back, or statement credits. The power lies in maximizing your spending by earning points that translate into tangible benefits.

Over time, the popularity of rewards credit cards spread globally, including in the United Arab Emirates (UAE), where financial institutions adopted and adapted the concept to cater to the preferences and lifestyles of consumers in the region. Today, rewards credit cards in the UAE continue to evolve with various offerings and partnerships, providing cardholders with multiple benefits and incentives based on their spending patterns.

Features of Points Rewards Credit Cards

Points rewards credit cards in the UAE offer various features designed to attract and benefit cardholders. The following are some essential characteristics of these cards generally:

Earn Points on Spending

Cardholders earn reward points for every dirham spent using the credit card.

Points are often awarded based on specific spending categories, such as groceries, dining, travel, and more.

Bonus Sign-Up Points

Redemption Options

Points can be redeemed for various rewards, including travel vouchers, merchandise, cashback, or statement credits.

Some cards provide the flexibility to transfer points to airline or hotel loyalty programs.

Travel Benefits

No Foreign Transaction Fees

Discounts and Offers

Complimentary Concierge Services

Flexible Redemption Periods

Annual Fee and Interest Rates

Points rewards cards may have an annual fee, so it's essential to consider the cost versus the benefits.

Interest rates on outstanding balances can vary, and it's crucial to understand these terms to avoid unnecessary charges.

Security Features

Reward Point Caps and Expiry

Some cards may cap the points earned within a specific period or spending category.

Points may have an expiration date, so cardholders need to be aware of the validity period.

Before choosing a points rewards credit card in the UAE, individuals must assess their spending habits, lifestyle, and preferences to select a card that aligns with their needs and maximizes the potential benefits. Connect with the experts at My Banker to get the best Points Rewards Credit Card.

Choosing the Best Credit Card with Points Rewards

Selecting the right Points Rewards Credit Card requires careful consideration of individual spending habits, preferences, and lifestyle.

Here are some key factors to keep in mind:

Rewards Structure: Evaluate the rewards structure to ensure it aligns with your spending patterns. Some cards may offer higher points for specific categories such as travel, dining, or groceries.

Redemption Options: Look for flexibility in redemption options. The best cards allow you to redeem points in multiple ways, offering versatility in how you enjoy your rewards.

Annual Fees and APR: Consider the annual fees and annual percentage rates (APR) associated with the card. It's essential to weigh these costs against the potential benefits to ensure the card is financially viable.

Sign-Up Bonuses: Many Points Rewards Credit Cards entice new users with attractive sign-up bonuses. Assess the value of these bonuses and how they fit into your overall financial strategy.

Top Points Rewards Credit Cards:

Some Top Points Rewards Credit Cards are as follows:

Al Masraf World Elite Mastercard

Annual Fee- AED 750

TOP REASONS TO CHOOSE

Emirates NBD Manchester United Credit Card

Annual Fee- AED 262.5

TOP REASONS TO CHOOSE

Exclusive offers for Manchester United Football Club Fans

Earn "Red" rewards points on all spends

Save up to 40% at more than 100 golf courses across the globe.

Complimentary lounge access at more than 10 regional airports

Connect with My Banker

Points Rewards Credit Cards have established themselves as valuable tools for savvy consumers. To sail over this , My Banker is your dedicated partner for all your banking needs, standing ready to assist. With a commitment to Putting "You" First, My Banker is a hope of trust and innovation in the financial industry. We simplify the complex world of credit cards, providing a streamlined and user-friendly platform to compare and contrast the cards that matter most to you. As you embark on your journey to smart spending, let My Banker guide you towards the credit card that best suits your financial objectives. For any inquiries, please contact us via email at service@my-banker.com .