Compare Credit Cards

Credit cards have become an important monetary tool for individuals and businesses. With numerous options available, it's crucial to compare credit cards in Dubai. to find the one that best suits your needs.

For this reason, we created our cutting-edge Credit Card Comparison tool to restore your freedom of choice. This tool lets you quickly choose and compare any three credit cards you like.

In this guide, we will explore how to effectively compare credit cards in the UAE, utilizing resources like My Banker to streamline the process.

How Does Credit Card Work in UAE?

Credit cards in the UAE operate similarly to those in other countries. They allow cardholders to make purchases and transactions up to a specified credit limit. These transactions accumulate as a balance owed to the credit card issuer. Cardholders are needed to make minimum monthly payments, but they have the option to pay the entire balance to avoid accruing interest charges. Additionally, credit cards often come with various perks such as cashback rewards, travel benefits, and discounts on purchases.

What Are the Advantages of Using a Credit Card?

There are various advantages to using a credit card in the UAE:

Convenience: Comparing the best credit card in UAE is a suitable way to make purchases, whether online or in person, without the need to carry large amounts of cash.

Rewards: Many credit cards offer bonus programs that allow cashback on investments. Cardholders can earn points and miles, which can be redeemed for travel, merchandise, or statement credits.

Security: Credit cards offer improved security features such as fraud protection and zero-liability policies, which protect cardholders from unauthorized transactions.

Build Credit History: Responsible credit card users can build a good credit history, which is necessary to be approved for loans, mortgages, and other financial items in the future.

Connect with My Banker To Find the Perfect Credit Card

My Banker is a valuable platform for comparing credit cards in the UAE. We provide comprehensive information on various credit card offerings, including interest rates, rewards programs, fees, and additional benefits. By using My Banker, consumers can easily compare multiple credit cards side by side, enabling you to make informed decisions based on their financial preferences and requirements.

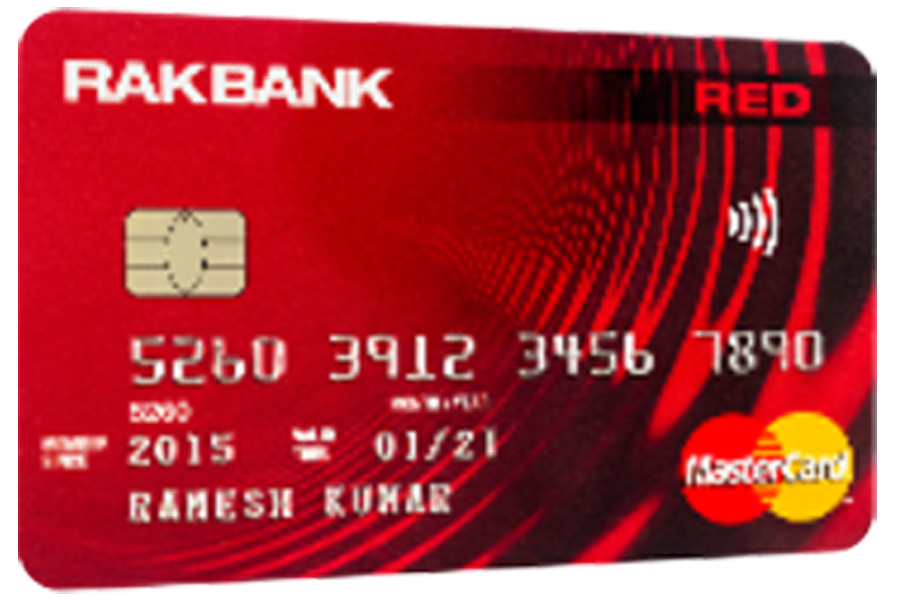

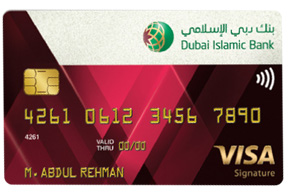

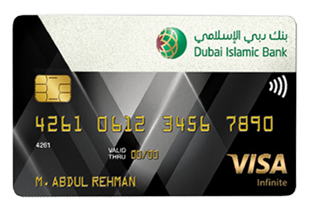

Click here to find our top credit card recommendations for you.

Eligibility Requirements for Credit Cards in the UAE

While eligibility requirements may vary depending on the credit card issuer, common criteria for compare credit cards in UAE include:

Minimum Age: To apply for a credit card in the UAE, one must be at least 21 years old.

Minimum Income: Credit card issuers may require applicants to have a minimum monthly income of AED 5000 to qualify for a credit card.

Credit History: A good credit history may increase the likelihood of approval for a credit card and may also affect the credit limit and interest rate offered.

Factors to Consider When You Compare Credit Cards in Dubai

Do you need clarification while choosing the right credit card?

We understand it can be a challenging decision unless one is well-informed.

To assist you, My Banker has outlined the following essential points to consider before Comparing the best credit card for you:

Rate of Interest

An important factor to consider is the interest rate when applying for a credit card. Evaluate your financial situation and spending patterns before deciding on a credit card.

Tip: Opt for a card with a low interest rate to avoid disrupting your future financial plans.

Fees

Credit card comparison in UAE comes with various charges such as annual fees, late fees, overlimit fees, etc. It's crucial to carefully review the fee information before finalizing your credit card choice.

Minimum Income Requirement

Each credit card has a minimum income threshold, so it's important to check the income requirement before applying and choose a card that aligns with your monthly income.

Key Benefits and Rewards

Every credit card offers unique rewards and benefits, which can be advantageous when making purchases. You can compare credit cards to find the one that provides the maximum benefits and rewards based on your needs.

Get your Credit Card Today

Comparing credit cards in Dubai and the UAE is essential for finding the best option that aligns with your financial goals and lifestyle. By utilizing resources like My Banker, understanding how credit cards work, and considering the benefits and eligibility requirements, individuals can make informed decisions when choosing a credit card that suits their needs. Whether you prioritize rewards, low fees, or additional perks, there is a credit card available in the UAE to meet your requirements.