Cashback Credit Cards in UAE

In credit cards, the promise of cashback has become an enticing proposition for consumers looking to make the most of their spending. In the United Arab Emirates (UAE), the world of credit cards offering cashback rewards has expanded significantly, allowing users to earn back a percentage of their spending. Today, we dive into cashback credit cards, exploring the best options available and how they can benefit your financial lifestyle. In the United Arab Emirates, credit card users highly favour cashback credit cards. It is difficult to compare and determine which is best Cashback Cards that fits your spending pattern when so many are available. My Banker provides the information you need to choose while looking for a cashback credit card in the United Arab Emirates.

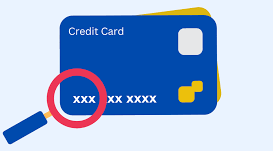

Understanding Cashback Credit Cards

A variety of credit card offers, and perks are available from banks to cardholders. One such reward program is cashback, in which the credit cardholder receives payment for some purchases made with the card. Many banks allow the cardholder to redeem their cashback points for discounts, airline miles, and other goods and services, and some even issue a credit back to the card account. Based on the bank's policy, cashback may be given monthly or yearly.

Cashback credit cards are designed to reward users with a percentage of their spending as a rebate. These cards typically offer different cashback rates for various categories, such as groceries, Dining, fuel, or general expenditures. The allure lies in earning back a fraction of your spending, effectively reducing your overall expenses.

Essential Terms About Cashback Credit Cards in the UAE

It is imperative that, before applying for a cashback credit card, you comprehend the precise meaning of the following phrases:

Minimum redemption

To be eligible for redemption, you must have a minimum amount of cashback. For instance, you cannot redeem cashback of less than AED 100 at a time from some banks because of their minimum redemption requirements.

Promotions

As a welcome offer, promotional pricing is available in a few categories. However, be aware that all promotions have a deadline after which the regular rates take effect.

Spend

For some cards, there may be a minimum spend requirement. In this case, to receive the cashback benefit, the minimum spend amount set by the bank for that category or, in general, must be fulfilled.

Easy Redemption

Banks sometimes make Redeeming rewards easier by requiring a call or a request made through their customer service channels. Citibank and HSBC are two examples of banks that offer an automatic cashback option, where cashback is automatically credited in the statements.

Category Caps

Banks can impose a maximum cap on a specific expenditure category. For instance, the ultimate reward amount on the FAB reward credit card is AED 150 for all monthly transactions involving petrol, utilities, and supermarket purchases.

Best Cashback Credit Cards in the UAE

Some of the credit card with highest cashback in the UAE are as follows:

Credit Card Name | Top Reasons to choose |

| 200,000 sign-up reward points Flight and hotel booking discounts Extensive premium travel & lifestyle benefits Earn rewards on all spends & cashback on specific categories.

|

| Earn up to 10% cashback on specific categories. Complimentary global airport lounge access with Lounge Key Up to five free supplementary credit cards

|

| No caps, no minimum spend, no redemption process & no spend 3% on non-AED spending | 2% on Grocery Spend | 1% on all Other Unlimited access to 1000+ lounges worldwide No Annual Membership fee in year 1 Get 15% off at Carrefour and 10% off at Amazon.

|

| 5% cashback on online purchases, utility bills, and school fees 5% cashback at the supermarket 1% cashback on everything else Unlimited Airport Lounge access 20% off on Careem rides

|

| 5% cashback on supermarkets and 3% on school fees and Dining Unlimited complimentary airport lounge access FAB credit card instantly. Zero paperwork

|

Finding the Best Credit Card for Cash Back

When assessing which cashback credit card suits your needs, consider the following factors:

Cashback Rates: Analyze the percentage of cashback offered for different spending categories and evaluate where you spend the most.

Annual Fees and Charges: Some cards might have annual fees or minimum spending requirements to unlock cashback rewards. Be mindful of these terms.

Additional Benefits: Look beyond cashback percentages. Consider supplementary benefits such as travel insurance, dining privileges, or discounts with partner merchants.

Redemption Options: Explore how and when you can redeem your cashback rewards. Some cards may offer direct statement credits, while others may have specific redemption criteria.

My Banker personal finance comparison site. Our specialists regularly examine credit card products on the market to give you helpful information about individual finance solutions.

Before registering for the card, we recommend reading and comprehending the terms of the individual reward program.

How to Make the Most of Your Cash Back Benefits

It's time to maximize your cashback credit card now that you have the ideal one. The following are some practical methods to increase your cashback rewards:

Make Use of Bonus Categories

Use your card to purchase within the designated bonus categories for higher cash back rates. Use your card for delivery or dining out, for instance, if it gives 5% cash back on Dining.

Combine Several Cards

Think about owning a few complimentary cashback credit cards. You can use the card with the best cashback percentage on a certain purchase to maximize your earnings.

Pay Your Entire Amount

Develop the practice of paying off your credit card debt fully and on schedule to avoid incurring interest and fees. In this manner, you can completely benefit from cashback returns without paying extra money.

Building Healthy Credit Habits

At My Banker, we believe in the significance of responsible credit card usage. To fully enjoy the rewards of a cashback credit card:

Pay On Time: Timely payments ensure you avoid interest charges and maintain a healthy credit score.

Monitor Spending: Stay within your means and use the credit card for planned expenses to avoid unnecessary debt accumulation.

Maximize Rewards: Understand the card's terms and spend strategically in categories with the highest cashback rates

Cashback credit cards in the UAE present a profitable opportunity for individuals seeking to make the most of their spending. Choosing the right card involves evaluating cashback rates, fees, and additional perks and aligning them with your spending habits. However, the key to unlocking the full potential of these cards lies in maintaining responsible credit habits. At My Banker, we encourage the careful use of credit cards to enhance financial well-being and maximize rewards. Remember, a cashback credit card can be a valuable financial tool when used wisely.