Islamic banking has become prominent in the UAE's ever-changing financial scene. It provides distinctive financial solutions that follow Sharia law. Islamic credit cards stand out among these products, providing consumers with an alternative to conventional credit cards while aligning with Islamic finance principles.

This article aims to delve into Islamic credit cards in the UAE, highlighting their features, benefits, and significance in the region's financial ecosystem and how My Banker will assist you in getting the best Islamic credit card for you.

Islamic Credit Cards

Islamic credit cards in the UAE are designed to comply with Sharia principles while providing consumers with the convenience and flexibility associated with conventional credit cards. These cards operate on the concept of 'riba' prohibition, meaning they do not charge interest on transactions or late payments. Instead, they may offer profit-sharing arrangements or charge fixed fees.

Additionally, Islamic credit cards often include features such as charitable donations, cashback rewards compliant with Sharia, and exclusive privileges. With the growing demand for Sharia-compliant financial products, Islamic bank credit cards play a significant role in meeting the needs of individuals seeking financial solutions that reflect their religious beliefs in the UAE.

Understanding Islamic Finance Principles

Sharia law roots Islamic finance, prohibiting the charging or receiving of interest (riba) and promoting risk-sharing, ethical investments, and economic participation. As such, Islamic financial institutions operate based on principles such as:

Prohibition of Interest (Riba): Islamic finance emphasizes the absence of interest in financial transactions, ensuring that profits and gains are generated through legal business activities rather than exploiting the time value of money.

Prohibition of Uncertainty (Gharar) and Speculation (Maysir): Transactions involving excessive uncertainty or speculation are prohibited, encouraging transparency and fair dealing in all financial dealings.

Asset-Backed Financing: Islamic finance promotes asset-backed financing, where investments are tied to tangible assets or services, ensuring transactions are grounded in actual economic activity

Features of Islamic Credit Cards

Some key features of Islamic Credit card in the UAE are:

Sharia Compliance: Islamic bank credit cards adhere to Sharia principles, ensuring that transactions are free from interest (riba) and comply with Islamic ethical standards.

No Interest Charges: Unlike conventional credit cards that accrue interest on outstanding balances, Islamic credit cards in UAE offer interest-free financing, promoting financial equity and social justice.

Profit-Sharing: Some best Islamic credit cards may provide profit-sharing arrangements, where cardholders share in the profits generated from Sharia-compliant investments made by the issuing bank.

Fee Structure: Islamic credit cards may impose fees for services such as late payments or cash withdrawals, but these fees are transparent and disclosed upfront to the cardholder.

Reward Programs: Many Islamic bank credit cards offer rewards that allow cardholders to earn points or cashback on their purchases, providing additional incentives for using the card responsibly.

Ethical Banking: By opting for Islamic credit cards, consumers support ethical banking practices aligned with Islamic values, promoting economic justice and social responsibility.

The Bottom Line

Islamic credit cards are vital in the UAE's financial landscape. They offer a Sharia-compliant alternative. Ethical banking practices are emphasized. Interest-free financing is a key feature. Profit-sharing arrangements are included. They provide a compelling option for individuals. Islamic principles guide financial management.

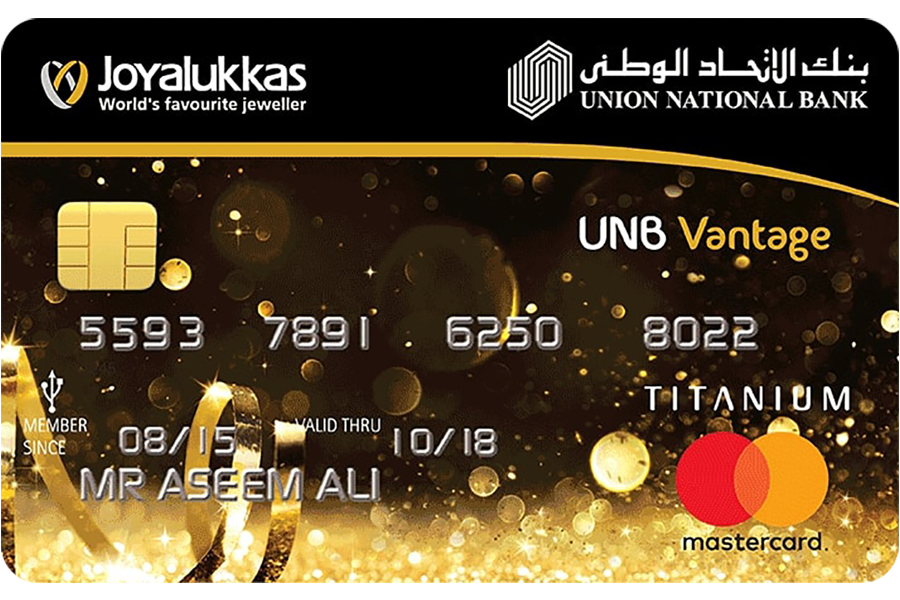

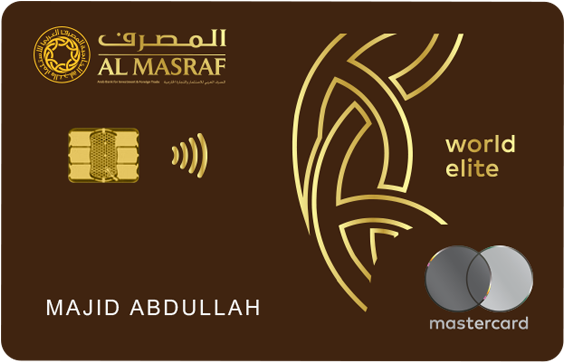

Since the Islamic finance industry is evolving. Islamic bank credit cards are crucial in the UAE. They cater to diverse financial needs. Emirates Islamic Credit Cards offer various benefits. Rewards and discounts are also available.

My banker will play a crucial role in helping you secure the best Islamic credit card according to your needs in the UAE. With our expertise in financial products and understanding of Islamic banking principles, we will guide you through the selection process, ensuring that the credit card aligns with your preferences and complies with Sharia law. From exploring various card features to analyzing terms and benefits, My banker will assist you in making an informed decision that suits your lifestyle and financial goals, providing you with peace of mind and confidence in your financial choices.