Emirates Skywards Cards

Emirates Skywards credit cards are like magic cards that turn your everyday spending into fantastic rewards! When you use these special cards, you earn points that can be transformed into awesome treats. Whether you dream of free flights, luxurious upgrades, or shopping sprees, these cards make it happen. It's like having a secret key to unlock extra goodies whenever you make purchases. So, with an Emirates Skywards credit card, your wallet becomes a ticket to exciting adventures and fabulous rewards! In this comprehensive guide, we'll delve into the details of these cards, exploring the perks, benefits, and why they're considered among the best in the industry.

Emirates Skywards Cards: An Overview

Emirates Skywards is the loyalty program introduced by Emirates Airlines, one of the world's leading aviation companies. Launched in the year 2000, the Skywards program was created to reward and recognize the loyalty of Emirates' frequent flyers. The program offers a range of benefits, including the accumulation of Skywards Miles, which can be redeemed for various perks such as flight upgrades, complimentary tickets, and access to exclusive events. The Skywards program caters to a diverse audience of travellers, from frequent business flyers to leisure travellers, providing a tiered membership system that offers escalating privileges based on the member's travel activity. The launch of Emirates Skywards aligns with the airline's commitment to enhancing the overall travel experience for its customers, fostering brand loyalty, and creating a mutually beneficial relationship between the airline and its valued passengers.

Emirates Skywards offers a range of cards tailored to suit the diverse needs of its members. These cards are designed to elevate your travel experience while providing exclusive privileges and rewards. These rewards can range from free flights to amazing shopping deals, making every swipe of your card a step closer to something special. So, think of your Emirates Skywards credit card as a magical passport that not only makes your payments easy but also opens doors to a world of thrilling perks and adventures.

Why Choose Emirates Skywards Credit Card

The Emirates Skywards Credit Card is a powerful tool that seamlessly integrates into the lives of frequent flyers and travel enthusiasts. This card opens doors to a host of benefits that redefine the way you experience air travel. Such as:

Earn Skywards Miles on Every Purchase

One of the primary attractions of the Emirates Skywards Credit Card is its ability to earn Skywards Miles on every transaction. These miles can be redeemed for flights, upgrades, resort stays, and many other lifestyle rewards.

Complimentary Lounge Access

Bid farewell to the hustle and bustle of airport terminals. With the Emirates Skywards Credit Card, relish the luxury of complimentary lounge access where comfort meets sophistication.

Discounts and Savings

The Emirates Skywards Credit Card saves you from travel-related expenses to retail and dining. Avail yourself of exclusive discounts, ensuring that every penny spent becomes an investment in your next adventure.

Travel Insurance

Some Emirates Skywards credit cards provide travel insurance, covering things like trip cancellations, lost luggage, and medical emergencies. This adds a layer of protection when you're on the go.

Exclusive Events and Offers

Being a cardholder might give you access to exclusive events, promotions, and discounts. This could include special concert tickets, shopping discounts, or unique travel experiences.

What are Emirates Membership Card Benefits?

In January 2022, Emirates, the airline based in Dubai, offered a membership program called Emirates Skywards. The benefits of the membership can vary based on the tier of membership (Blue, Silver, Gold, or Platinum). Here are some general benefits associated with Emirates Skywards membership:

Lounge Access: Higher-tier members often enjoy complimentary access to Emirates lounges and partner lounges worldwide.

Priority Check-in and Boarding: Gold and Platinum members typically receive priority check-in and boarding services.

Extra Baggage Allowance: Gold and Platinum members may receive additional baggage allowances.

Dedicated Customer Service: Gold and Platinum members usually have access to a dedicated customer service hotline for assistance.

Exclusive Offers: Members may receive exclusive offers, discounts, and promotions on flights, hotels, and car rentals.

Best Emirates Skywards Credit Card

Some of the Best Emirates Skywards Credit Cards are:

ADIB Emirates Skywards World Card

TOP REASONS TO CHOOSE ADIB Emirates Skywards World Card are:

Dubai Islamic Emirates Skywards Platinum Credit Card

TOP REASONS TO CHOOSE Dubai Islamic Emirates Skywards Platinum Credit Card are:

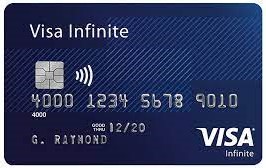

Emirates Islamic Skywards Infinite Credit Card

TOP REASONS TO CHOOSE Emirates Islamic Skywards Infinite Card are:

Up to 75,000 bonus Skywards Miles

Up to 2 Skywards Miles per USD equivalent spent

Fast-Track update to Emirates Skywards Silver Tier Status

AED 500 noon voucher (T&C's apply)

Emirates NBD Skywards Infinite Credit Card

TOP REASONS TO CHOOSE Emirates NBD Skywards Infinite Credit Card are:

Best-in-class Skywards Miles earning - earn and redeem

Earn up to 100,000 Skywards Miles

Complimentary Emirates Skywards Silver membership upgrade

AED 400 voucher from YouGotaGift

Choosing the Best Emirates Skywards Credit Card

Credit card offerings can change, and new products may have been introduced since then. To find the best Emirates Skywards credit card for your needs, consider the following general advice:

Research Current Offers: Look for the latest credit card offerings from financial institutions that partner with Emirates Skywards. Connect with My Banker to get the Best Emirates Skywards Credit Card.

Rewards and Benefits: Compare the rewards and benefits of different credit cards. Consider factors such as the earning rate of Skywards miles, welcome bonuses, complimentary airport lounge access, travel insurance, and other perks.

Fees and Charges: Pay attention to annual fees, foreign transaction fees, and other charges associated with the credit card. Ensure that the value of the rewards and benefits outweigh the costs.

Interest Rates: If you plan to carry a balance, consider the interest rates associated with the credit card. Look for a card with a competitive interest rate to minimize the cost of borrowing.

Flexibility and Redemption Options: Check the flexibility of redeeming Skywards miles. Some cards may offer more redemption options, such as flights, hotel stays, or merchandise. Choose a card that aligns with your preferred redemption choices.

Customer Service and Support: Consider the reputation of the credit card issuer for customer service and support. Read reviews from other cardholders to get an idea of customer satisfaction.

Credit Score Requirements: Ensure that you meet the credit score requirements for the credit card you are interested in. Higher-tier cards may have stricter eligibility criteria.

Explore New Heights with Emirates Skywards Cards

Emirates Skywards Cards, particularly the Emirates Skywards Credit Card, redefine the travel experience. Beyond the tangible benefits, these cards represent a commitment to excellence and a passport to a world where every journey is an adventure. Explore the skies with confidence, knowing that you have a powerful ally in your wallet, ready to unlock a world of exclusive privileges and rewards. Choose the best Emirates Skywards Credit Card and embark on a journey with My Banker. Connect with our experts to get the best Emirates Skywards credit card. Save time and effort with My BANKER when obtaining credit cards. For any inquiries, reach out to us via email at service@my-banker.com.