- Home

- About

-

Credit Cards

- Credit Card Types

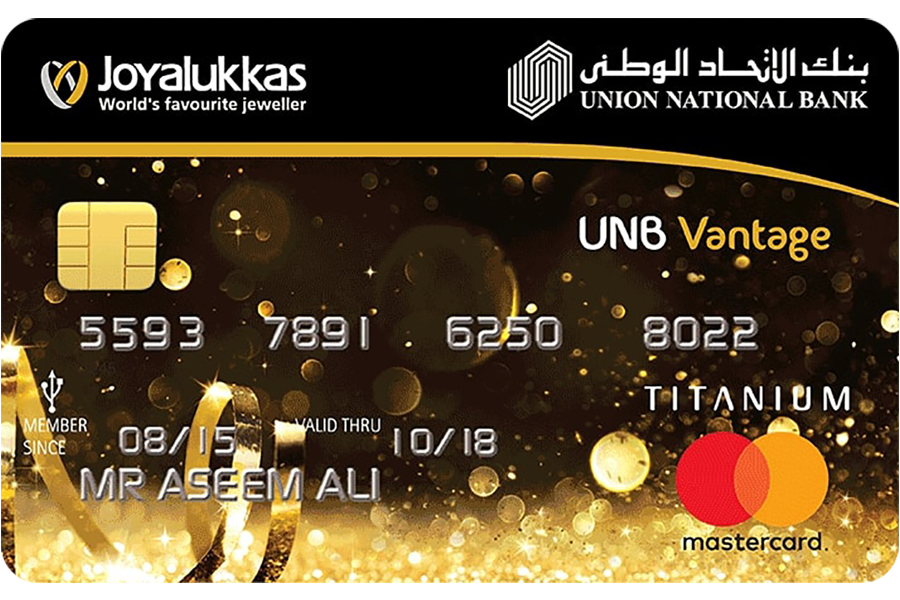

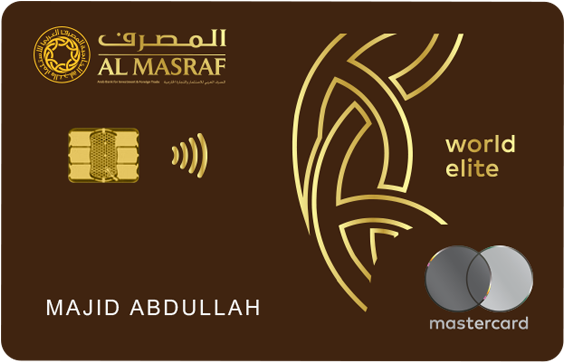

- Credit Cards in UAE

- Airport Lounge Credit Cards

- No Annual Fee Credit Cards

- Cashback Credit Cards

- Emirates Skywards Credit Cards

- Balance Transfer Credit Card

- Travel Credit Cards

- Concierge Service Credit Cards

- Points Rewards Credit Cards

- Business Credit Cards

- Gold Credit Cards

- Credit Card Features

- Cinema Movie Offers Credit Cards

- Dining Credit Cards

- Golf Offers Credit Cards

- Air Miles Credit Cards

- Health & Fitness credit cards

- Airport Lounge Access Credit Cards

- Car Registration Credit Cards

- Airport Chauffeur Services Credit Cards

- Cab Rides Credit Cards

- Cash Back

- Top Banks

- Rakbank Credit Cards

- Emirates Islamic Bank Credit Cards

- Dubai Islamic Bank Credit Cards

- Mashreq Bank Credit Cards

- HSBC Credit Cards

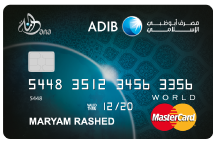

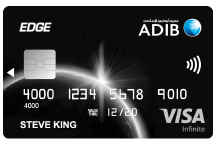

- Abu Dhabi Islamic Bank Credit Cards

- CITI Bank Credit Cards

- Abu Dhabi Commercial Bank Credit Cards

- Abu Dhabi Commercial Bank - Islamic Credit Cards

- First Abu Dhabi Bank Credit Cards

- Popular Credit Cards

- CITI Bank

- Citi Cashback Credit Card

- FAB Masdar Platinum Credit Card

- Union National Bank Cashback Card

- CBI First World Mastercard Credit Card

- EMIRATES ISLAMIC Skywards Gold Credit Card

- Dubai first Cashback Card

- Dubai Islamic Consumer Platinum Card

- Deem Mastercard Titanium Cash Up Credit Card

- Dubai Islamic Consumer Reward Card

-

Business Loan

- Business Loan Types

- Business Loans in UAE

- Startup Loans

- Trade Loans

- Small Business Loans

- Term Loan

- Equipment Financing Loans

- Microfinance Loans

- Business Vehicles Loans

- Business Lines of Credit

- Business Loan Features

- Competitive Interest Rates

- Dedicated Relationship Manager

- Repayment Period

- Easy Documentation

- Insurance Funding

- Introductory Offers

- No Equity Required

- Islamic Finance

- No Salary Transfer

- Top Up Facility

- Business Loan Banks

- RAK Bank

- Commercial Bank of Dubai Business Loan

- SME Bank

- Emirates Islamic Bank

- First Abu Dhabi Bank

- Dubai Islamic Bank

- Abu Dhabi Commercial Bank

- Mashreq Bank

- HSBC Bank

- Aseel Bank

- Popular Business Loans

- Emirates Money Equipment Loan

- HSBC First Loan

- Dubai Islamic Bank - Business Finance

- Emirates Islamic - Business Finance

- Gulf Finance Small Business Loans

- Emirates Money Business Loan

- Emirates Money Loan for Rent a Car Companies

- Aseel Business Finance

- Emirates Money Personal Loan

- Emirates Money Commercial Vehicles Loan

- Compare Cards

- Blog